Reporting entities should continue to use existing guidance notes and information sheets for reporting periods that began prior to 1 July 2024.

Update September 2024

The Regulator is updating its guidance materials for the new Payment Times Reporting Scheme.

We will consult on the process so people can engage with the Regulator and understand the new requirements.

Simplified guidance to assist entities to identify whether they are a reporting entity under the Payment Times Reporting Scheme.

Download

On this page

- Who needs to report

- Identifying a reporting entity

- Volunteering entities

- Further information

- Text descriptions

This information sheet provides general guidance only and does not amount to legal advice. Entities are encouraged to seek independent legal advice to clarify their rights and obligations under the Act.

Who needs to report

Reporting entities, as defined under the Payment Times Reporting Act 2020 are required to submit payment times reports. Reporting entities can be:

- large businesses operating in Australia (income over A$100 million)

- some entities operating in Australia that are part of a large corporate group (total group income over A$100 million), or

- entities that volunteer to report.

Entities registered under the Australian Charities and Not-for-profits Commission Act 2012 (ACNC Act) are exempt from reporting but can volunteer to report. This exemption cannot be relied on by charities and not-for-profits that are not registered under the ACNC Act.

Identifying a reporting entity

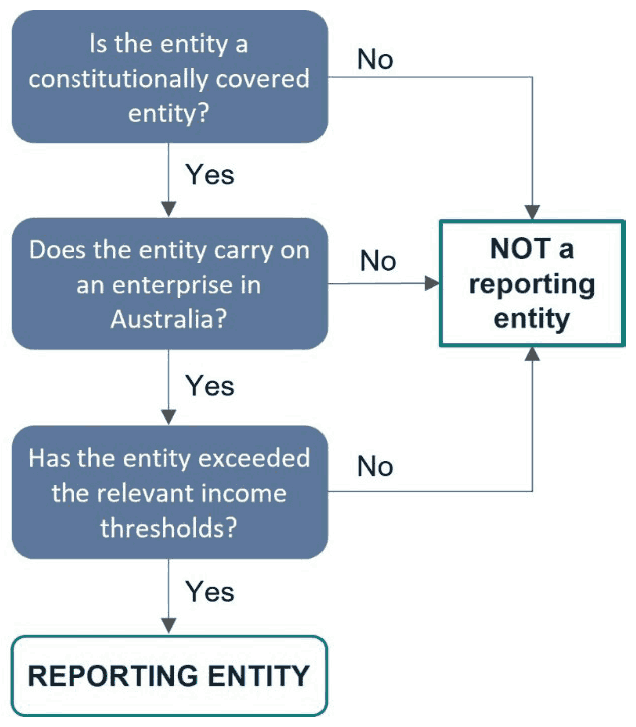

To identify if a business is a reporting entity you need to consider the following:

- Is the entity a constitutionally covered entity?

- Does the entity carry on an enterprise in Australia?

- Has the entity exceeded the relevant income thresholds?

An entity that answers yes to all 3 criteria is generally a reporting entity and required to submit a payment times report.

Whether an entity engages with, or makes payments to, small business suppliers is not a criterion for identifying if an entity is a reporting entity.

Step 1: Is the entity a constitutionally covered entity?

Constitutionally covered entity is a term used in the Payment Times Reporting Act 2020 to define reporting entities.

Determining whether an entity is a constitutionally covered entity requires assessment of the underlying activities and place of business of the entity.

Set out below are common scenarios where an entity may be a constitutionally covered entity. More information is available in Guidance Note 1: Key concepts.

Entities likely to be constitutionally covered entities

Foreign entities and entities incorporated in Australia that trade or provide financing are generally constitutionally covered entities. This includes:

- entities that are incorporated under the Corporations Act 2001 (Pty Ltd, Ltd, NL companies)

- joint ventures, trustees, partnerships and government businesses that have been incorporated

- entities incorporated under state-based legislation (Inc)

- government businesses that have been incorporated

- foreign incorporated entities.

Entities that may be constitutionally covered entities

Other types of entities, including partnerships and cooperatives that have not been incorporated, may be constitutionally covered entities if they carry on an enterprise in an Australian territory.

Examples of carrying on an enterprise are listed in Step 2: Carrying on an enterprise in Australia. If these activities are taking place in an Australian territory, the entity may be a constitutionally covered entity.

Australian territories include the Australian Capital Territory, the Northern Territory, Jervis Bay and external territories.

If you are unsure if your entity is a constitutionally covered entity, we encourage you to seek independent legal advice.

Step 2: Carrying on an enterprise in Australia

Carrying on an enterprise in Australia is a broad term that can include anything in relation to the commencement, running or termination of a business.

Activities that may indicate, but not determine, that an entity is carrying on an enterprise in Australia include:

- having an office, retail or other premise in Australia from which business is conducted

- marketing and providing goods or services to Australian consumers

- having an Australian Business Number (ABN)

- being required to submit an income tax return or business activity statement to the Australian Taxation Office (ATO)

- employing staff members that are permanently based in Australia.

Although having a physical presence in Australia may indicate an entity is carrying on an enterprise in Australia, it is not a requirement. An entity with no physical presence in Australia can be carrying on an enterprise in Australia depending on its activities in Australia.

If you are unsure if your entity is carrying on an enterprise in Australia, we encourage you to seek independent legal advice.

Step 3: Income thresholds

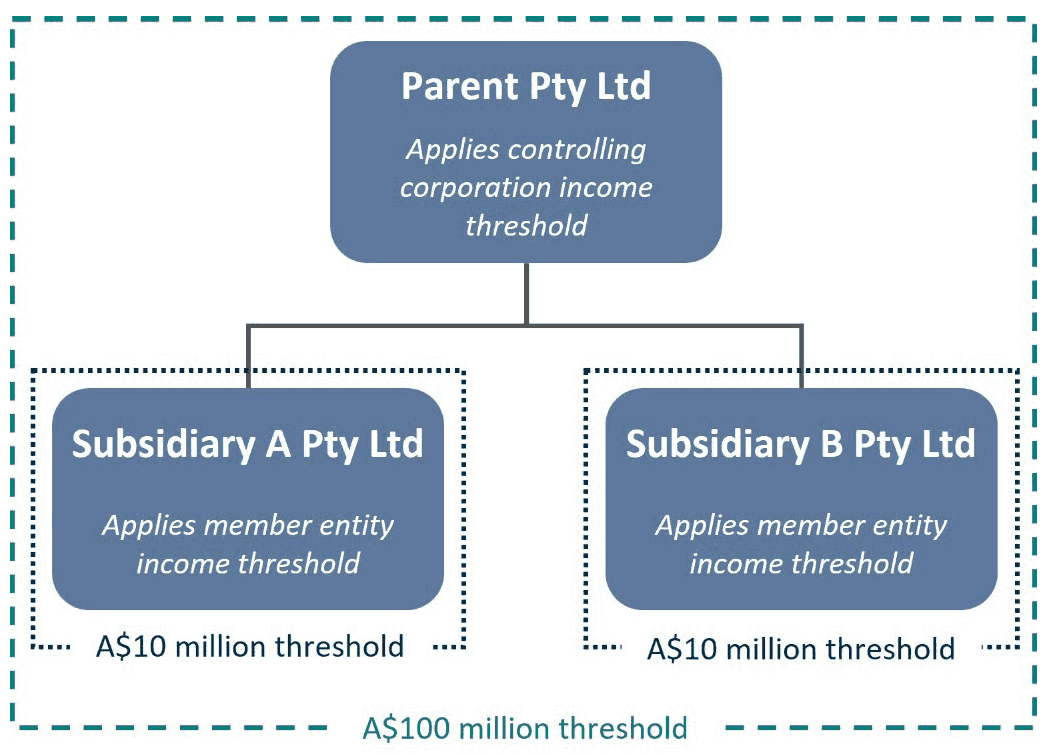

The general income threshold applicable is A$100 million in an entity’s most recent income year. The only exception to the general income threshold is for entities that are part of a corporate group.

Where an entity is part of a corporate group, it may need to apply 2 income thresholds to determine whether it is a reporting entity.

| Threshold | Determination |

|---|---|

| Threshold 1 |

If the entity:

it is a controlling corporation and a reporting entity. |

| Threshold 2 |

If the entity is a subsidiary of a controlling corporation and has income greater than A$10 million it is a member entity and a reporting entity. |

A controlling corporation that is a reporting entity must report even if they do not earn income. In these cases, the entity will submit a ‘nil’ report: see Guidance Note 2: Preparing a payment times report.

More information about corporate groups is available in Information sheet 4: Corporate groups.

Calculating total income

To determine total income:

- If the entity is not part of a tax consolidated group, it can use the amount reported in its income tax return provided to the Australian Taxation Office (item 6S in company tax returns).

- If the entity does not prepare an income tax return or, cannot use its tax return information because it is part of a tax consolidated group, it may:

- use the total revenue recognised under AASB standards (or another International Financial Reporting Standards equivalent), if the entity prepares financial statements in accordance with those standards, or

- prepare a notional total income calculation as though it was preparing an income tax return individually, or preparing a financial statement under Australian accounting standards.

More information about applicable thresholds and calculation of total income is available in Guidance Note 1: Key concepts.

Volunteering entities

Entities that volunteer to report, continue to be reporting entities until they apply for, and are granted, a determination to cease to be a reporting entity.

For information about volunteering and applying for a determination to cease to be a reporting entity, see Guidance Note 3: Applications and notifications.

Further information

For more information, please refer to the additional guidance notes and information sheets available in the Guidance section of the Payment Times Reporting Regulator’s website.

Text descriptions

Text description of Figure 1

- Is the entity a constitutionally covered entity?

- No: Not a reporting entity

- Yes: Does the entity carry on an enterprise in Australia?

- No: Not a reporting entity

- Yes: Has the entity exceeded the relevant income thresholds?

- No: Not a reporting entity

- Yes: Reporting entity

Text description of Figure 2

Parent Pty Ltd has 2 subsidiary entities: Subsidiary A Pty Ltd and Subsidiary B Pty Ltd. Each subsidiary applies member entity income threshold of A$10 million. Parent Pty Ltd applies controlling corporation income threshold. The threshold of Parent Pty Ltd and its 2 subsidiaries is A$100 million.